Why now is a good time to invest

Time and discipline may be your greatest allies when investing. Just like an acorn needs time to grow into an oak tree, your money needs time to grow. The sooner you start investing, the more time your money has to grow, and the easier it is to accumulate wealth.

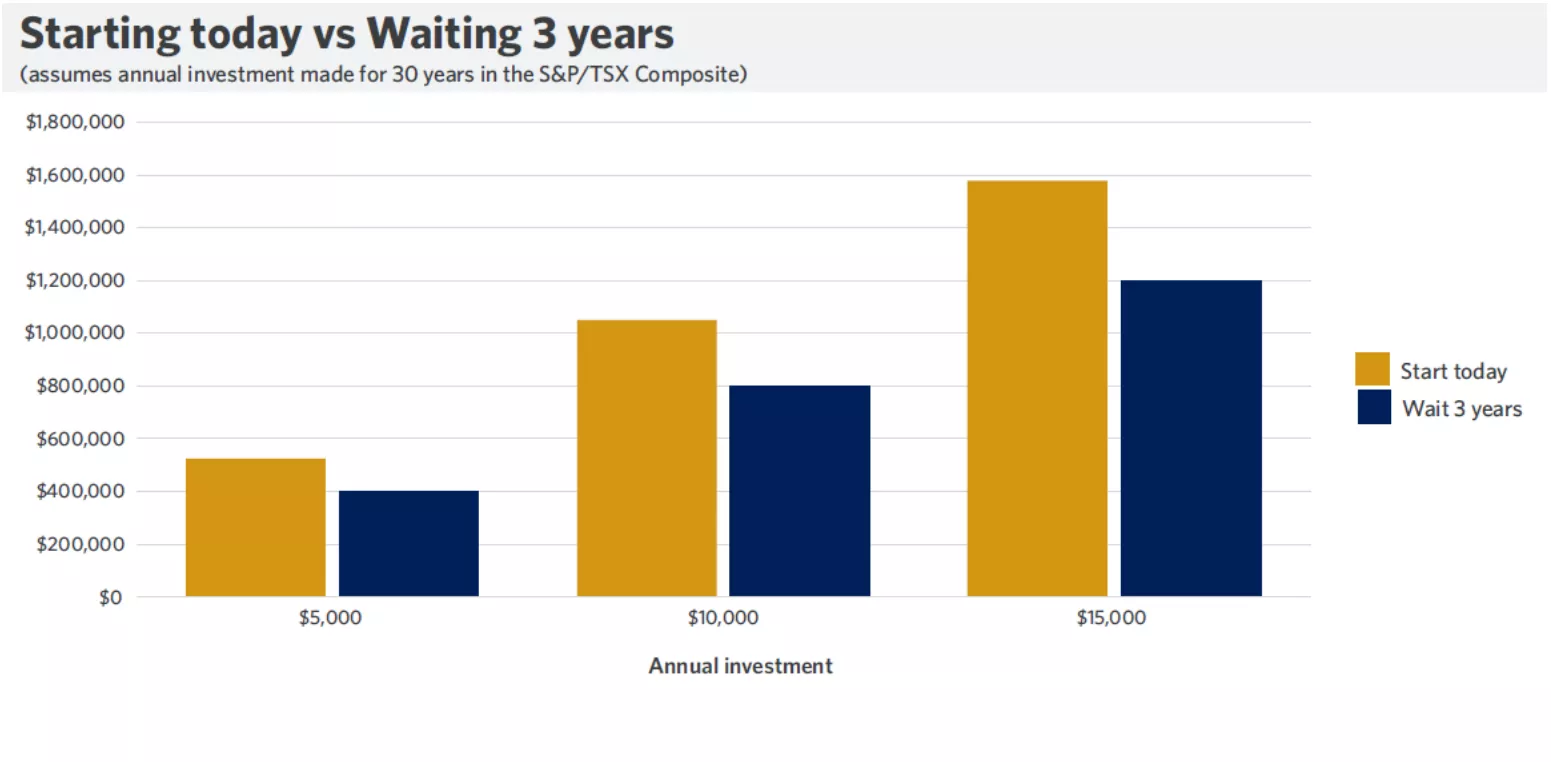

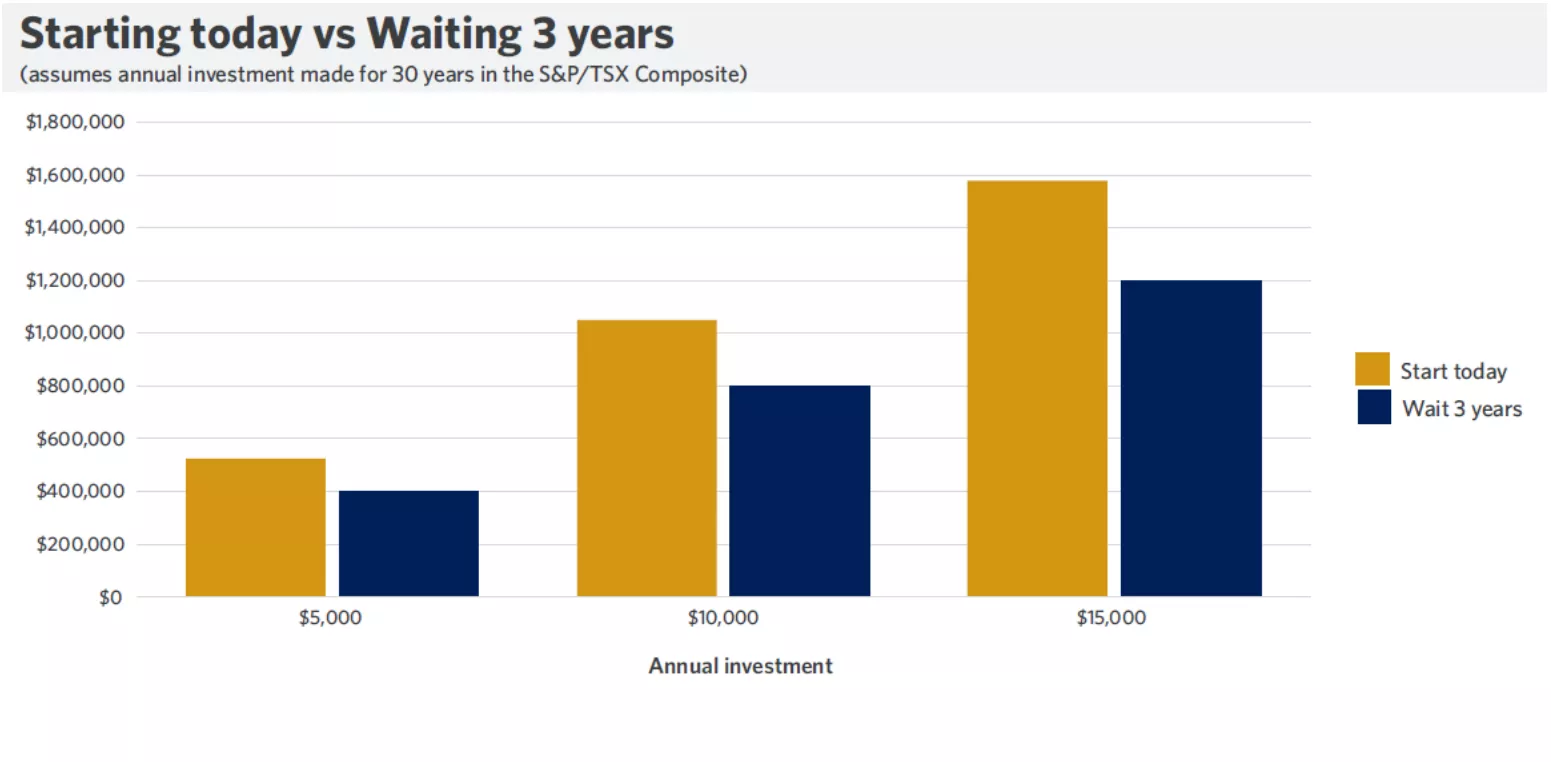

This chart shows how using time to your advantage may help you reach your investment goals sooner.

This chart shows how using time to your advantage may help you reach your investment goals sooner.

Consider a 35-year old who wants to retire at 65. Assuming they received the S&P/TSX Composite Total Return Index rate of return, the benefit of starting today versus waiting three years is significant. Based on a $10,000 annual investment, the cost of waiting just three years is over $200,000. Time is a valuable commodity. That’s why we recommend that you get started early and invest when you have the money available.

How we can help

Talk to your Edward Jones advisor about starting today.

Important information:

Past performance does not guarantee future results.