Monthly portfolio brief

Solidifying your investment philosophy

What you need to know

- While it may be hard to believe, considering the intensely volatile start to August, asset class returns were rather muted last month and nearly all asset classes have produced double-digit returns over 12 months.

- Additionally, some of the year's top-performing investments have fallen behind recently. Some Canadian, overseas, and value-style markets have taken the lead over certain tech-related investments, with bonds also demonstrating their value.

- These trends highlight the value of staying opportunistic yet focused on a long-term, diversified approach to investing – key tenets of our disciplined investment philosophy.

- We recommend making slight adjustments to well-diversified stock and bond allocations, including by overweighting stocks and increasing sensitivity to interest rates, to help portfolios benefit from easing monetary policies and supportive economic trends.

Portfolio tip

An investment philosophy focused on quality investments, a long-term approach and proper diversification can help you navigate volatility while staying opportunistic.

This chart shows the performance of equity and fixed-income markets over the previous month and year.

This chart shows the performance of equity and fixed-income markets over the previous month and year.

Where have we been?

Portfolios benefited from double-digit one-year returns across most all asset classes, despite growth scares in early August. The first few days of August gave investors quite the shock, particularly since it followed a lengthy period of lower volatility most of this year. Growth concerns within tech stocks and signs of a weakening labour market were among the factors that caused markets to drop, weighing on portfolio performance.

But you wouldn't know this occurred by reviewing month-end returns alone. One-month returns were rather muted across most asset classes as overall economic trends remained supportive and the U.S. Federal Reserve further solidified expectations for a less restrictive monetary policy. In addition, the Bank of Canada has now cut rates three times, following their September cut.

Eight of the 11 asset classes have produced one-year returns well into double digits, with cash-like investments falling toward last place. These overall strong returns have benefited those who stayed invested in a well-diversified portfolio despite restrictive monetary policies, economic growth scares and periods of market volatility.

Within equities, some tech-heavy markets fell behind and newer leaders supported portfolios the most. U.S. large-cap stocks have stood out over the year as enthusiasm surrounding artificial intelligence propelled the tech-heavy asset class higher. Significant tech leadership further increased stock and sector concentration within U.S. large caps, which is important to keep in mind when reviewing your portfolio's composition. More recently, gains have broadened as different sectors began outperforming, such as real estate, financials and utilities.

As sector leadership rotated, Canadian and developed overseas large-cap stocks, which have trailed U.S. large-cap stocks so far this year, produced the highest returns last month. Though, the outperformance was only by slight margins given rather muted or slightly negative returns across most equity asset classes. Smaller, more cyclical asset classes underperformed their large-cap peers across all regions with U.S. small- and mid-cap stocks dropping the most.

Interest rates trended lower, helping to send bonds higher and cushion the volatility. While the work is still not complete, higher-quality fixed income continued to climb back from the losses they incurred over the last three years. Interest rates have ticked lower in response to expectations for a softening economy, lower inflation and the onset of U.S. Federal Reserve rate cuts, helping most fixed income asset classes finish the month higher and smooth the volatility for well-diversified portfolios.

What do we recommend going forward?

Prepare portfolios for a period of easing monetary policies and supportive economic growth. We expect inflation to trend toward central bank targets, allowing monetary policies across multiple regions to become less restrictive over time – supporting consumer spending, business investment and overall economic growth, avoiding a recessionary collapse

This environment is likely to help propel stock and bond portfolio allocations in the months ahead. However, we recommend favouring stocks over bonds when building a portfolio around your strategic asset allocation. Our guidance is depicted below if you're looking for help.

Within equities, overweight U.S. stock allocations across all market capitalizations. We expect momentum within U.S. large-cap stocks to continue, backed by the relative strength of the U.S. economy and a broadening trend as lagging sectors play catch-up. When slightly reallocating portfolios toward U.S. large-cap, consider doing so from Canadian large-cap and emerging-market stocks, given relatively higher economic uncertainties within Canadian and Chinese equities.

Additionally, consider enhancing diversification beyond the year's top-performing, large-cap tech-oriented stocks. These stocks are likely to benefit from the long-term growth prospects of artificial intelligence (AI), supporting our neutral recommendation to the sector. However, in the near term, we recommend overweighting industrials, given their cyclical nature, and utilities, given their interest rate sensitivity. Each of these two sectors, among others, have recently demonstrated their catch-up potential, and we believe there's room for more progress.

U.S. small- mid-cap stocks have lagged U.S. large-cap stocks, but we believe their catch-up potential also appears attractive, particularly as the U.S. Federal Reserve embarks on a potential multi-year rate-cutting cycle. We expect their more cyclical nature to be beneficial, and the asset class can help portfolios maintain a level of quality as well. When slightly reallocating portfolios toward U.S. small- and mid-cap stocks, consider doing so from international bonds to help implement an overweight to equity investments.

Within fixed income, overweight higher-quality, longer-term bond allocations. As inflation trends lower and economic growth slows, interest rates are likely to drift downward, as they have recently. When interest rates move lower, bond investments with more interest-rate sensitivity receive a greater boost. Longer-term bonds are generally more interest-rate sensitive than shorter-term bonds, which is key to our recommendation to overweight these types of investments.

Short-term bonds and cash-like investments may have appeared increasingly attractive as interest rates rose, but they carry reinvestment risk, which is important to consider when interest rates are likely to head lower. Therefore, reduce overweight positions to these types of investments, particularly before central banks move too far into their rate-cutting cycles. Consider locking in the benefits of today's higher rates by overweighting longer-term bonds within Canadian investment-grade bond allocations.

Prepare for additional volatility with a solid investment philosophy. Debates surrounding central bank rate cuts are likely to continue in the coming months, as will the focus on elections, the strength of the economy and geopolitical uncertainties, among other investor concerns. Therefore, while the early August market volatility quickly subsided, additional periods of market volatility are likely to occur.

An investment philosophy focused on quality investments, a long-term approach and proper diversification can help you face uncertainty with patience and discipline. Additionally, view periods of volatility as opportunistic moments to add quality investments at lower prices. To further prepare, we recommend investors:

Revisit expectations for potential portfolio fluctuations. Appropriate long-term performance expectations can help you stay patient when bouts of volatility occur, particularly when your portfolio's mix between stocks and bonds is aligned with your comfort with risk and financial goals.

Consider global diversification. Diversification can help manage risk and reduce – though not eliminate – overall portfolio volatility. More specifically, incorporating international asset classes into a portfolio can help manage exposure to Canadian-specific risks and may also enhance long-term return potential.

For example, Canadian large-cap stocks carry a high degree of sector concentration. The energy, materials and financials sectors make up 60% of the Canadian large-cap stock asset class. In addition to spreading out these sector exposures, international diversification can help manage currency risks, regulatory risk, political risks and economic risk, among many others. Therefore, consider stock and bond allocations across a variety of developed and emerging markets to help you steer through volatility with greater discipline.

We're here for you

Talk with your financial advisor about how our investment philosophy can guide you toward your financial goals and market opportunities that may help boost your progress towards those goals. If you don’t have a financial advisor and would like to build an investment strategy grounded in the principles of quality, diversification and a long-term focus, we invite you to meet with an Edward Jones financial advisor.

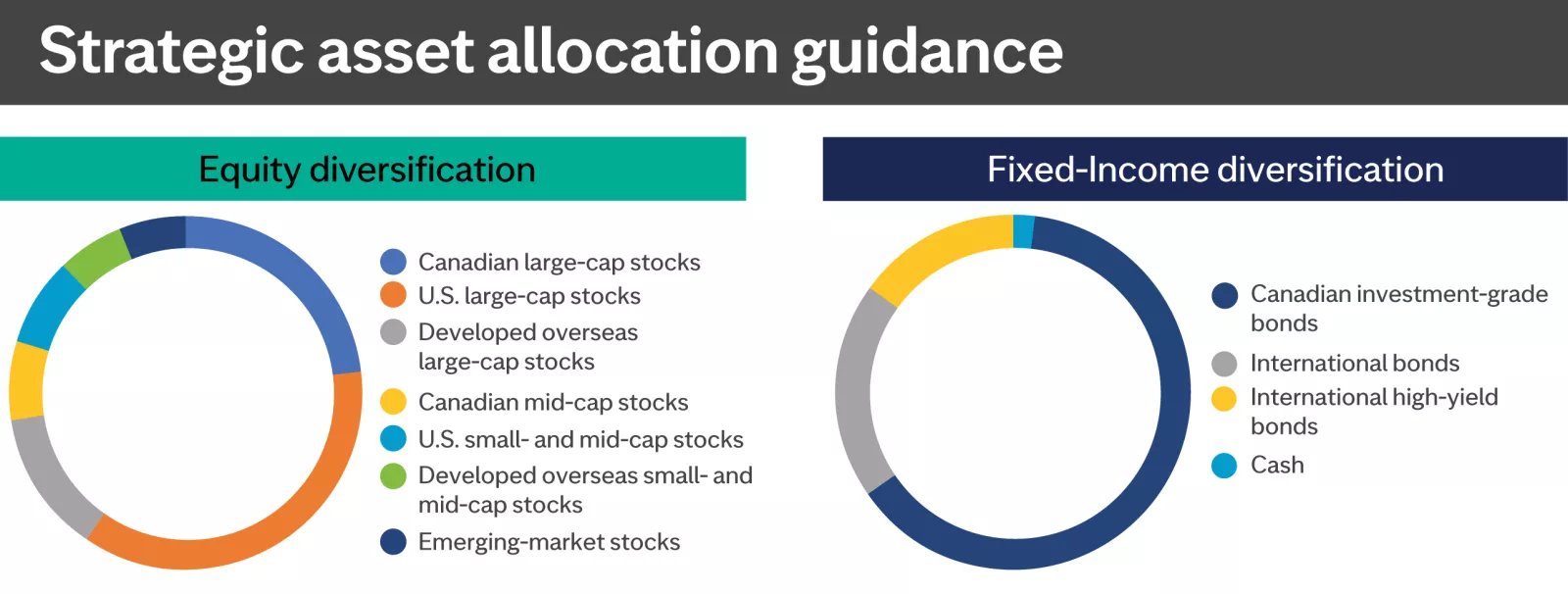

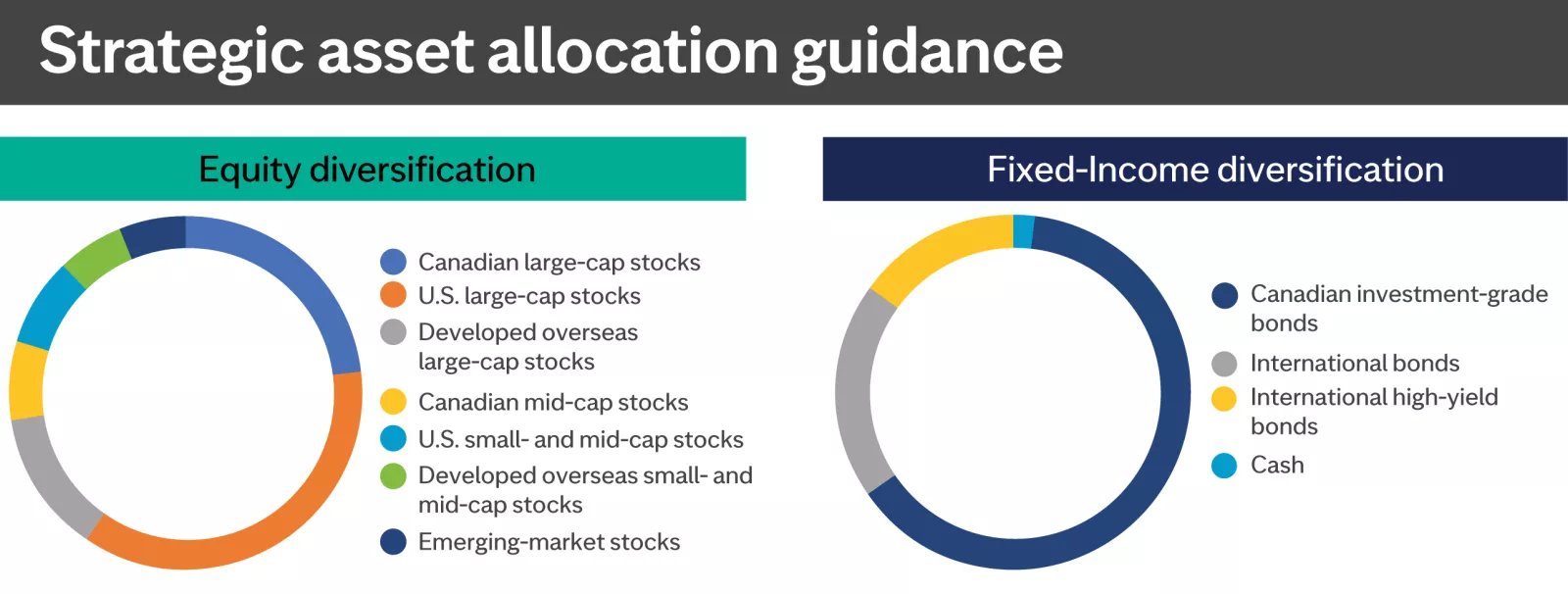

Strategic portfolio guidance

Defining your strategic investment allocations helps to keep your portfolio aligned with your risk and return objectives, and we recommend taking a diversified approach. Our long-term strategic asset allocation guidance represents our view of balanced diversification for the fixed-income and equity portions of a well-diversified portfolio, based on our outlook for the economy and markets over the next 30 years. The exact weightings (neutral weights) to each asset class will depend on the broad allocation to equity and fixed-income investments that most closely aligns with your comfort with risk and financial goals. Diversification does not ensure a profit or protect against loss in a declining market.

Within our strategic guidance, we recommend these asset classes:

Equity diversification: Canadian large-cap stocks, U.S. large-cap stocks, developed overseas large-cap stocks, Canadian mid-cap stocks, U.S. small- and mid-cap stocks, developed overseas small- and mid-cap stocks, emerging-market stocks.

Fixed-income diversification: Canadian investment-grade bonds, international bonds, international high-yield bonds, cash.

Within our strategic guidance, we recommend these asset classes:

Equity diversification: Canadian large-cap stocks, U.S. large-cap stocks, developed overseas large-cap stocks, Canadian mid-cap stocks, U.S. small- and mid-cap stocks, developed overseas small- and mid-cap stocks, emerging-market stocks.

Fixed-income diversification: Canadian investment-grade bonds, international bonds, international high-yield bonds, cash.

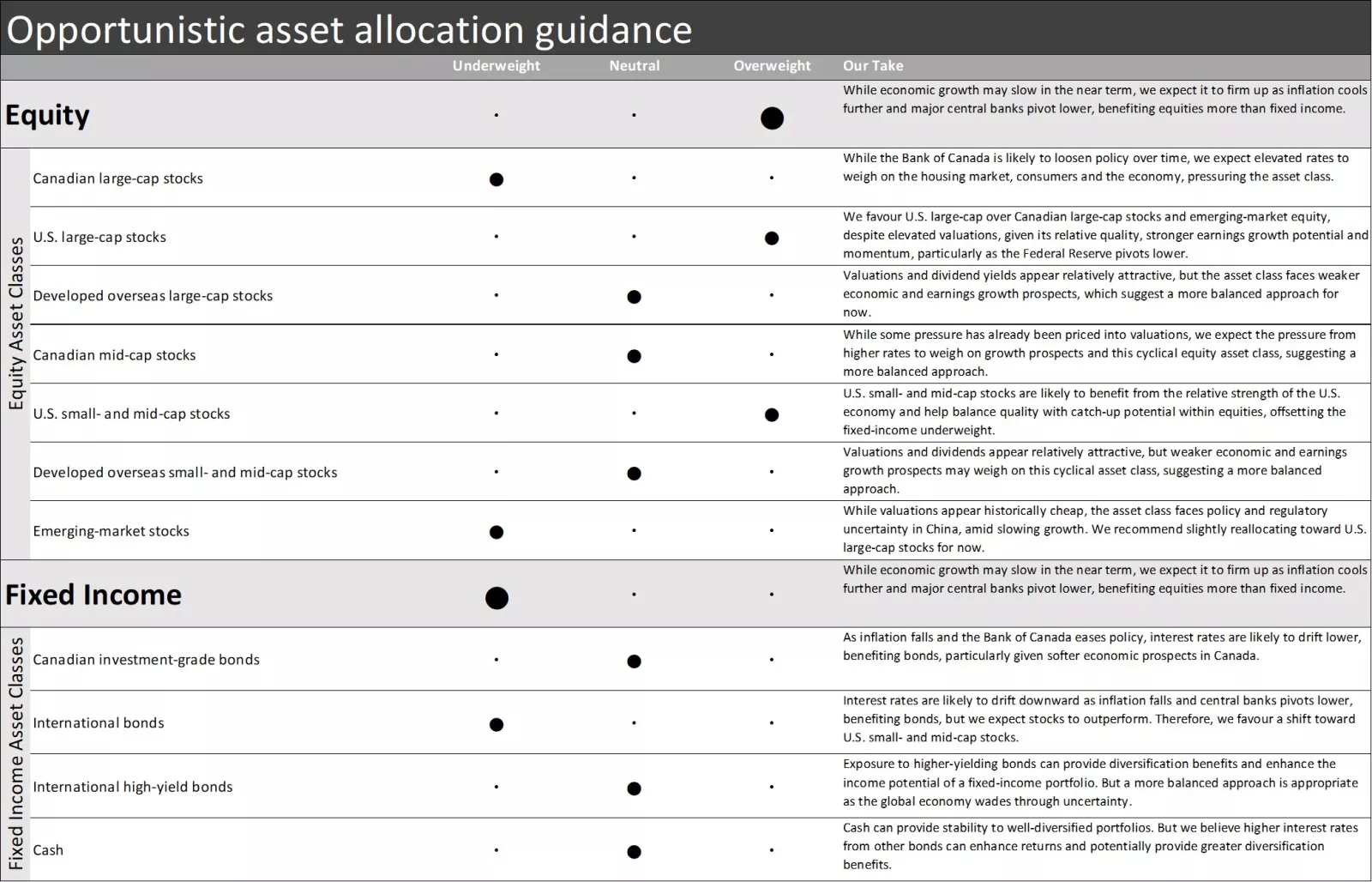

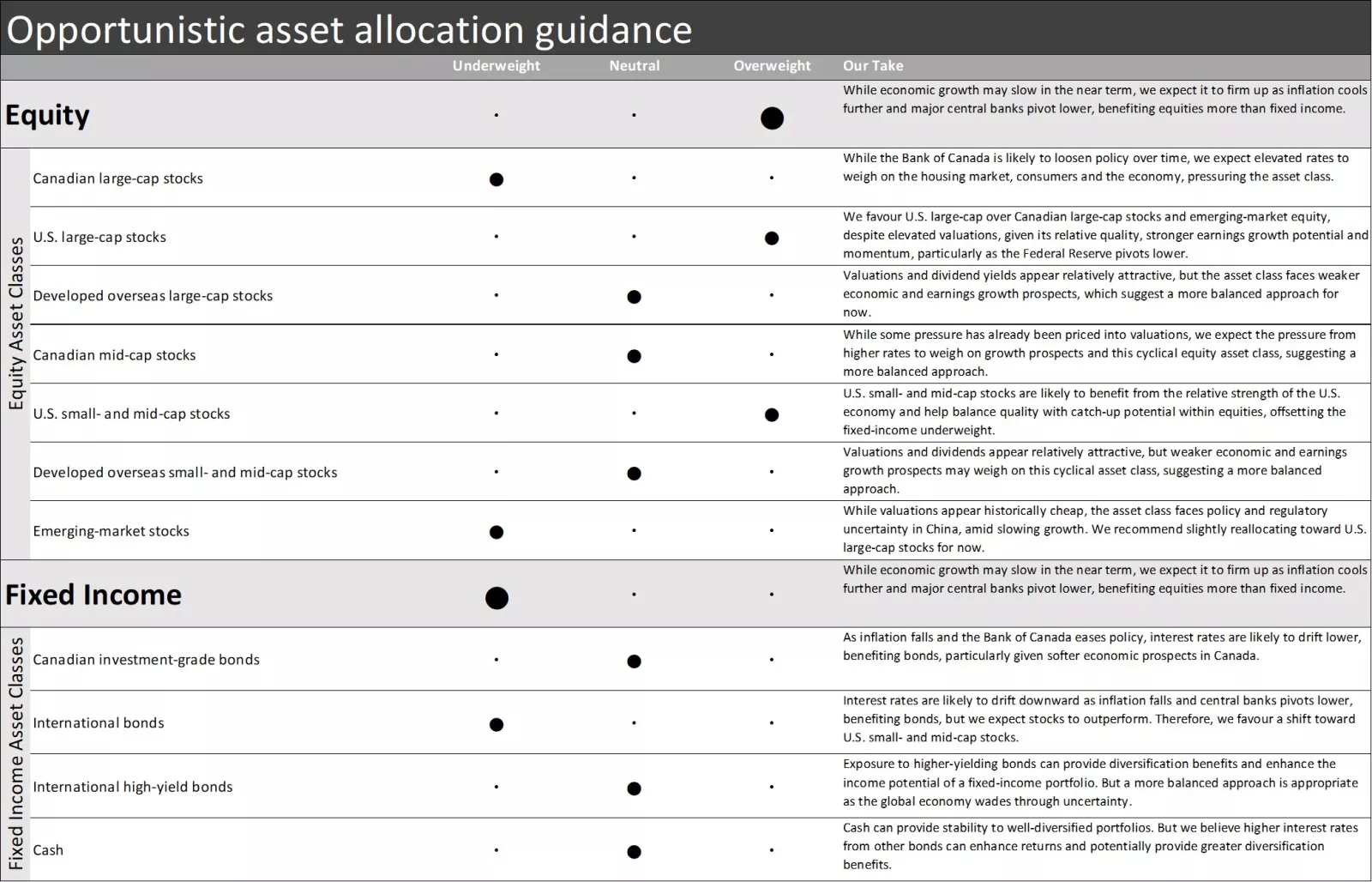

Opportunistic portfolio guidance

Our opportunistic portfolio guidance represents our timely investment advice based on current market conditions and a shorter-term outlook. We believe incorporating this guidance into a well-diversified portfolio may enhance your potential for greater returns without taking on unintentional risks, helping to keep your portfolio aligned with your risk and return objectives. We recommend first considering our opportunistic asset allocation guidance to capture opportunities across asset classes. We then recommend considering opportunistic equity sector and Canadian investment-grade bond guidance for more supplemental portfolio positioning, if appropriate.

Our opportunistic asset allocation guidance is as follows:

Equity —overweight overall; underweight — Canadian large-cap stocks and emerging market stocks, neutral — Canadian mid-cap stocks, developed overseas large-cap stocks and developed overseas small- and mid-cap stocks, overweight — U.S. large-cap stocks and U.S. small- and mid-cap stocks.

Fixed income —underweight overall; neutral — Canadian investment-grade bonds, international high-yield bonds and cash, underweight – international bonds.

Our opportunistic asset allocation guidance is as follows:

Equity —overweight overall; underweight — Canadian large-cap stocks and emerging market stocks, neutral — Canadian mid-cap stocks, developed overseas large-cap stocks and developed overseas small- and mid-cap stocks, overweight — U.S. large-cap stocks and U.S. small- and mid-cap stocks.

Fixed income —underweight overall; neutral — Canadian investment-grade bonds, international high-yield bonds and cash, underweight – international bonds.

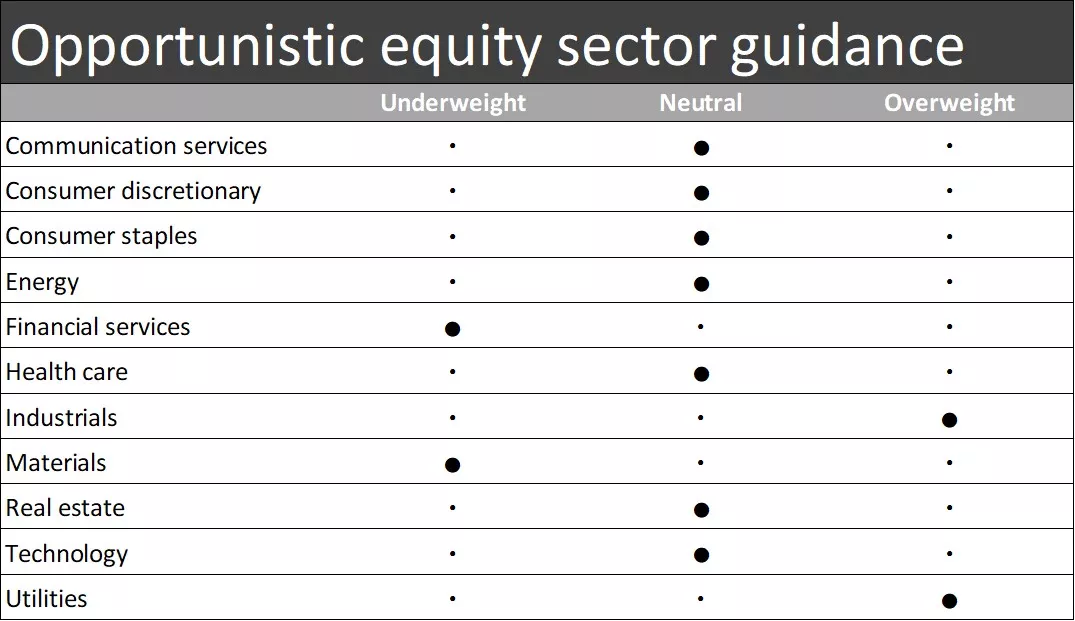

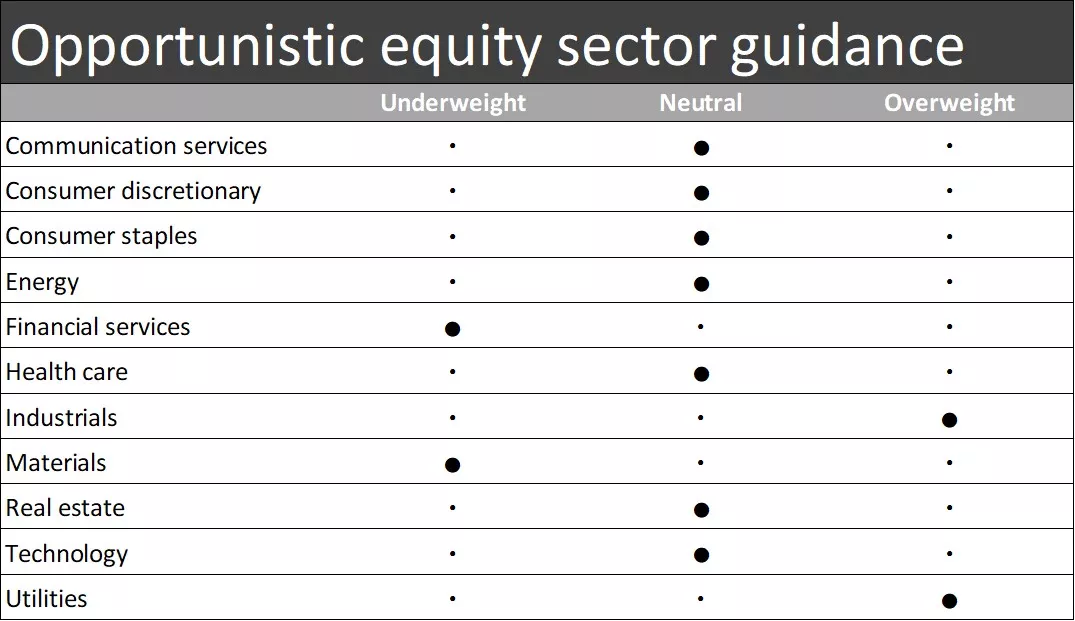

Our opportunistic equity sector guidance follows:

Overweight for industrials and utilities

Neutral for communication services, consumer discretionary, consumer staples, energy, health care, real estate and technology

Underweight for financial services and materials

Our opportunistic equity sector guidance follows:

Overweight for industrials and utilities

Neutral for communication services, consumer discretionary, consumer staples, energy, health care, real estate and technology

Underweight for financial services and materials

Our opportunistic Canadian investment-grade bond guidance is overweight in interest rate risk (duration) and neutral in credit risk.

Our opportunistic Canadian investment-grade bond guidance is overweight in interest rate risk (duration) and neutral in credit risk.

Tom Larm, CFA®, CFP®

Tom Larm is a Portfolio Strategist on the Investment Strategy team. He is responsible for developing advice and guidance related to portfolio construction, asset allocation and investment performance to help clients achieve their long-term financial goals.

Tom graduated magna cum laude from Missouri State University with a bachelor’s degree in finance. He earned his MBA from St. Louis University, is a CFA charter holder and holds the CFP professional designation. He is a member of the CFA Society of St. Louis.

Important information

*Systematic investing (or dollar cost averaging) does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining. Rebalancing does not guarantee a profit or protect against loss, and may result in a taxable event.

Past performance of the markets is not a guarantee of future results.

Investing in equities involves risk. The value of your shares will fluctuate, and you may lose principal. Small-cap stocks tend to be more volatile than large-company stocks. Special risks are involved in international and emerging-market investing, including those related to currency fluctuations and foreign political and economic events.

Diversification does not ensure a profit or protect against loss in a declining market.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.High-yield bonds carry risk of principal loss and may experience more price volatility than investment-grade bonds.