Sustainable investing: A socially conscious approach to investing

What is sustainable investing?

Sustainable investing enables you to invest your money in a socially conscious way according to your personal preferences and values. Interest in sustainable investing has grown in recent years due in part to heightened investor demand, increased corporate awareness and greater investment product availability. As a result, many companies are elevating their business practices and policies to be more in line with environmental, social and governance (ESG) factors to meet this demand and help ensure market resilience in an ever-changing economic environment.

Whether you want to encourage better corporate behavior, make a positive impact on the environment and society, or align your personal views with your portfolio, there are options that can help you achieve your goals. To learn more about how to do this, view our webinar, “How Does Socially Responsible Investing Work?”

Understanding ESG considerations

Sustainable investing incorporates environmental, social and governance or "ESG" considerations in the investment decision. Let's look at some examples of ESG factors and what companies can do to better align themselves with these considerations:

| Environmental |

|

| Social |

|

| Governance |

|

What are my sustainable investment options?

Many professionally managed investments, such as mutual funds and exchange-traded funds (ETFs), incorporate ESG considerations into their process. They may do this by integrating it as one part of the overarching investment process, or they might have a primary and intentional focus on ESG.

Traditional funds may choose to integrate ESG considerations only to the extent it is financially material to the investment decision. These fund managers continue to prioritize financial return over ESG considerations. Importantly, these investments may not be marketed and viewed as sustainable investments.

Sustainable investing options at Edward Jones could include ESG intentional funds or a sustainable thematic and impact strategy, defined as follows.

1. ESG intentional strategies

If you want to invest in companies that have “best-in-class” ESG practices or encourage companies to improve their policies, you may want to consider an ESG intentional strategy.

With these strategies, you can invest in individual companies that meet the ESG standards you are looking for or invest in an ESG intentional fund. With ESG intentional funds, fund managers evaluate companies’ ESG policies and practices as part of the investment decision along with, but not ahead of, financial performance considerations. These funds tend to be broadly diversified across industries and sectors and prioritize a common set of ESG considerations.

Like traditional funds, ESG intentional funds perform differently depending on various factors such as the investment team’s skill, the strength of the investment process and the fund’s internal expenses. Additionally, because ESG intentional funds also focus on financial return and diversification, they should perform similarly to traditional fund strategies.

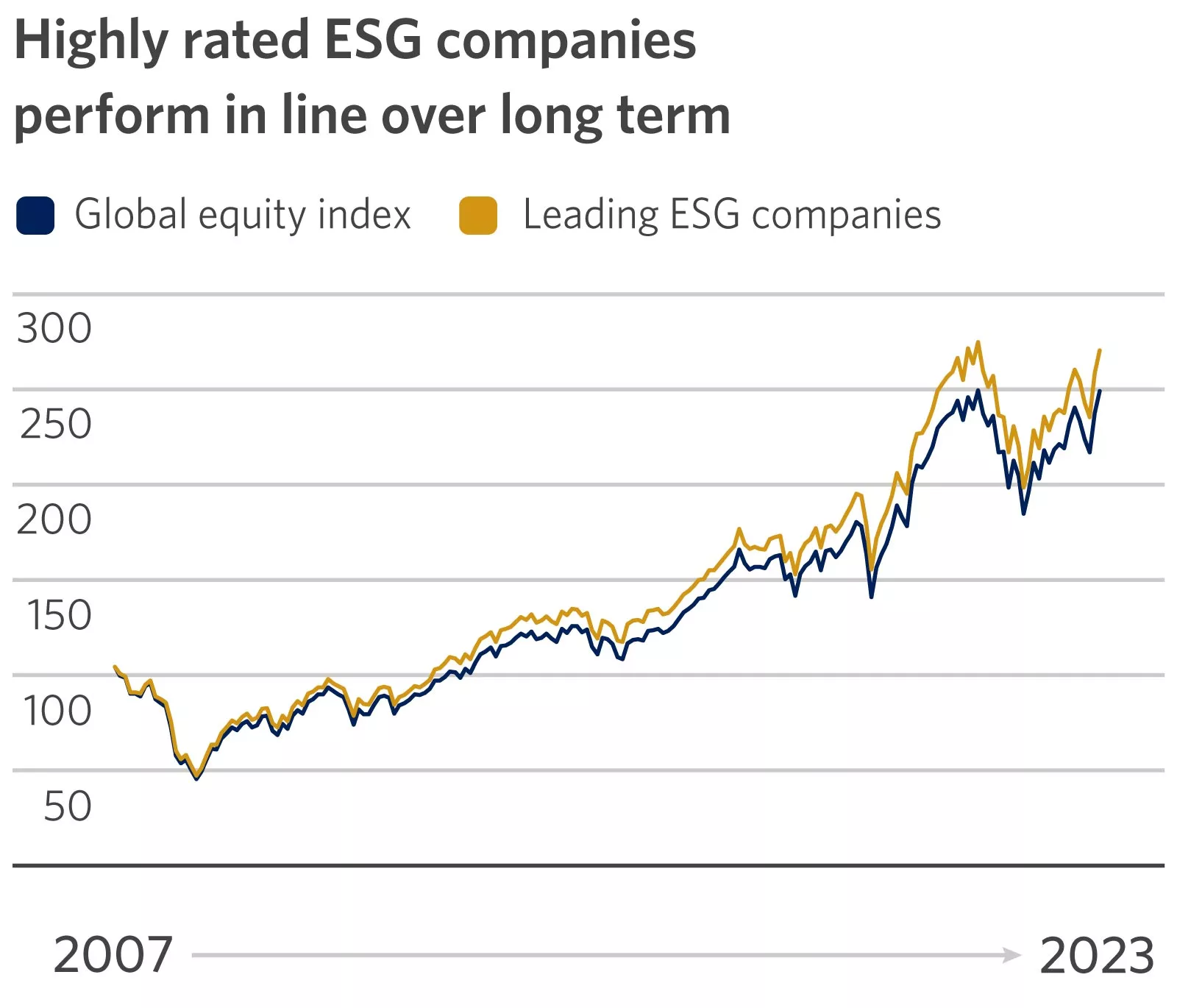

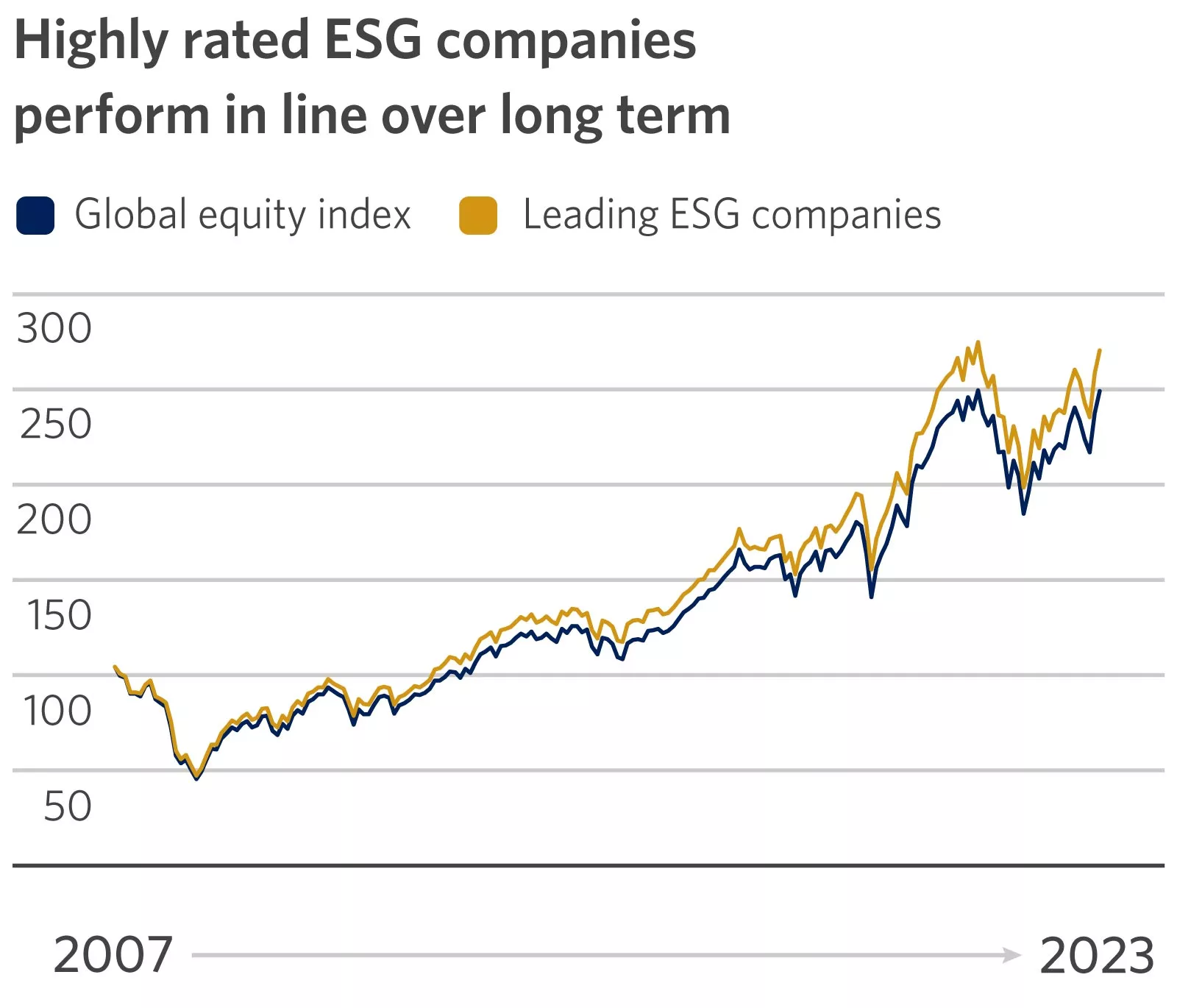

Source: Morningstar Direct. Index performance measured from 10/1/2007 to 12/31/2023. The Global Equity Index is represented by the MSCI ACWI NR index and Leading ESG Companies is represented by the MSCI ACWI ESG Leaders NR index. Indexes are unmanaged and not available for direct investment. Past performance is not a guarantee of future results.

While all investments perform differently over time, this chart compares a broad group of global companies to those with high ESG ratings. The group of highly rated ESG companies performed roughly in line with the broader group.

Some mutual funds and exchange-traded funds (ETFs) available at Edward Jones are considered ESG intentional funds and are labeled accordingly.

2. Sustainable thematic and impact strategies

While ESG intentional funds tend to be broad and diversified, you can achieve a more direct intent with a sustainable thematic or impact strategy. Sustainable thematic strategies have one or more specific investment themes targeting an environmental or social issue, such as renewable energy, that may take precedence over financial returns.

Impact investments go a step further by prioritizing the impact of a single objective or project, such as clean water or affordable housing, over the financial return of that investment. Due to this narrower focus, however, we caution investors on the potential for performance trade-offs to meet the sustainable goal they wish to support.

Sustainable thematic mutual funds, ETFs, and individual securities that may meet your nonfinancial goals are available at Edward Jones.

How you can take action now

If you are interested in incorporating more sustainable investing strategies into your overall financial strategy, talk to your financial advisor to determine whether sustainable investing is right for you.

What you need to know

- The decision to incorporate your nonfinancial goals into your financial objectives is a personal choice.

- Make sure the goals and objectives of a sustainable investment align with your expectations. Your financial advisor can help you understand any potential trade-offs so you can decide what’s right for you.