Volatility returns, but the bull market remains intact

Key takeaways:

The recent market selloff was dramatic and perhaps even jarring for investors as they kicked off the first week of August. On Aug. 5, the Dow Jones was down by over 1,000 points, its worst decline in two years. The S&P 500 shed about 8.5% from peak to trough since hitting an all-time high on July 16. Meanwhile, the technology-heavy Nasdaq fell into correction territory, down over 13% from its July highs.1

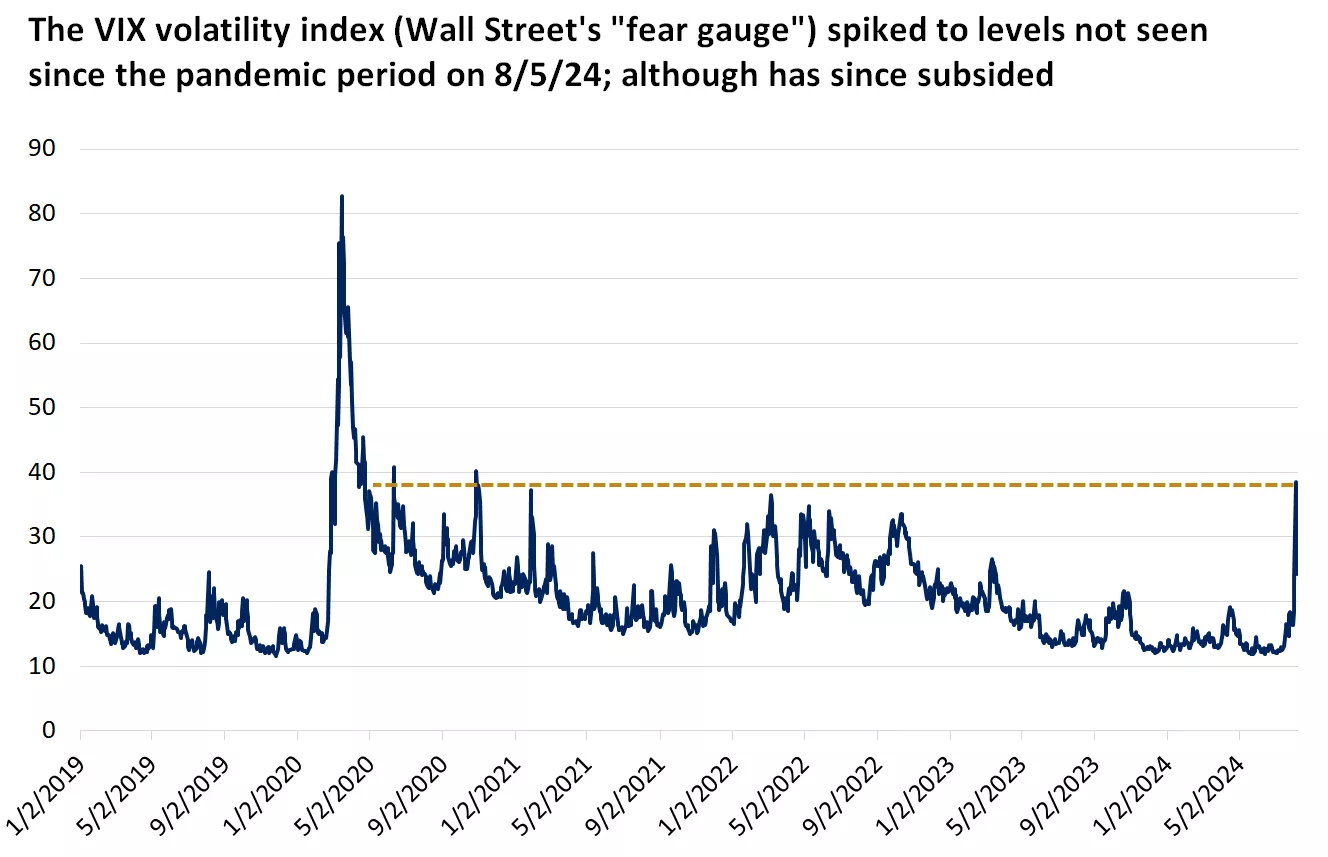

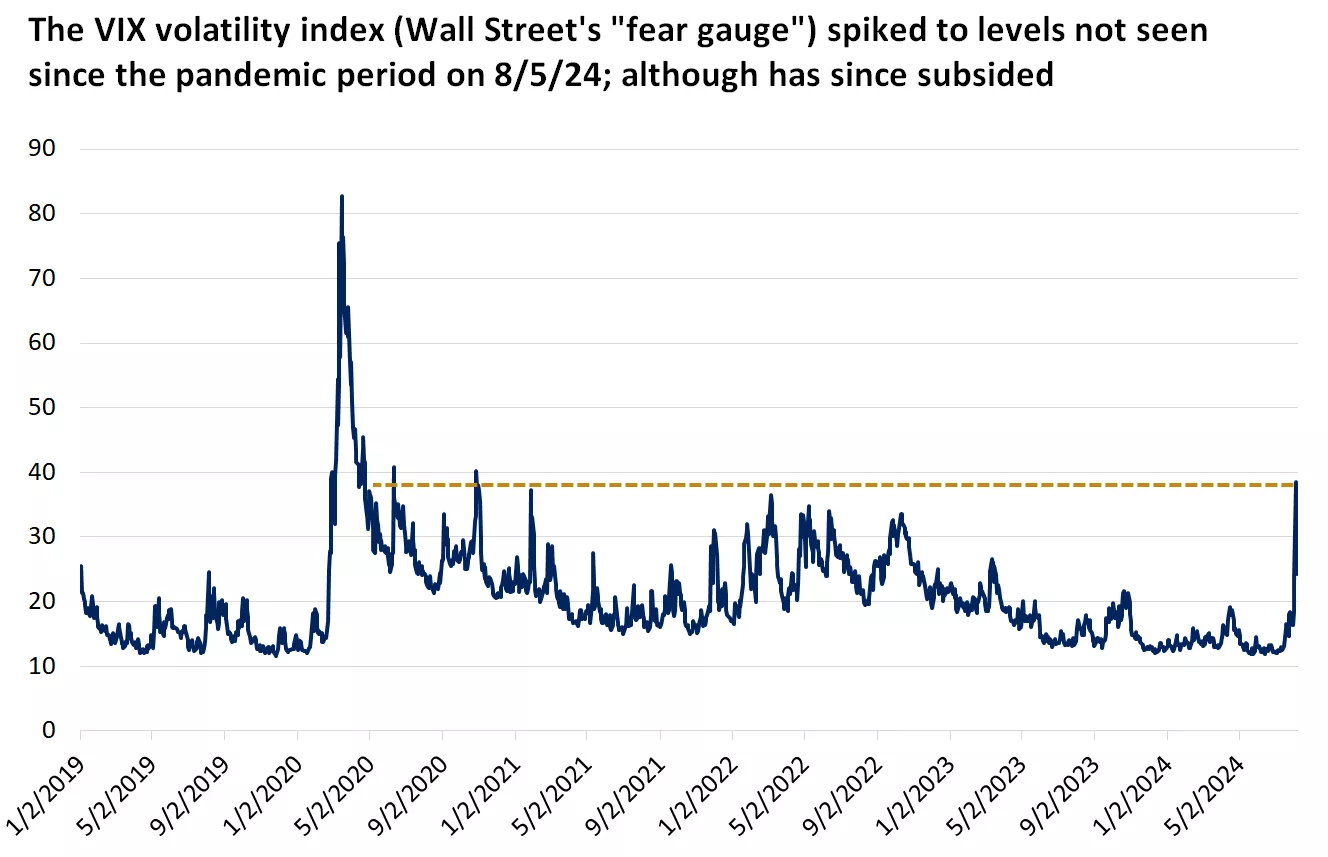

Investors flocked to safe-haven assets such as Treasury bonds, pushing bond yields to the lows of the year. Perhaps most striking was the VIX volatility index, also known as Wall Street’s “fear gauge,” which spiked to levels last seen during the pandemic era.

- However, as we know, markets can overreact to the downside and the upside. While this recent bout of volatility was unnerving, investors should try to keep emotions or anxiety from impacting their investment decisions. Despite the recent selloff, the S&P 500 is still up close 10% this year, while the U.S. Aggregate Bond index is up by over 2%.1

- The bottom line, in our view: Markets could remain choppy through a seasonally weaker September and October, and into U.S. Election Day. But to us this feels more like a natural correction following a rapid rally through most of 2024 rather than a signal of a deterioration in the fundamental foundation of this bull market.

This chart shows the level of the CBOE VIX volatility index. Volatility spiked in the first trading days of August.

This chart shows the level of the CBOE VIX volatility index. Volatility spiked in the first trading days of August.

What caused the market turmoil?

To some extent, it seemed a “perfect storm” of disruptive factors came together in recent days, including:

1. Weak economic data in the U.S., topped off by a soft jobs report — Over the last week of July, U.S. economic data consistently surprised to the downside. This included a spike higher in weekly jobless claims figures and a weaker-than-expected ISM manufacturing report that indicated the U.S. manufacturing sector remained in contraction.

Perhaps most worrisome to markets, the July nonfarm jobs report surprised to the downside, with the U.S. unemployment rate climbing to 4.3%, well above forecasts of a 4% unemployment rate. The weak jobs report on Aug. 2 sparked fears the U.S. economy may be falling into recession and the Federal Reserve had kept rates high for too long.

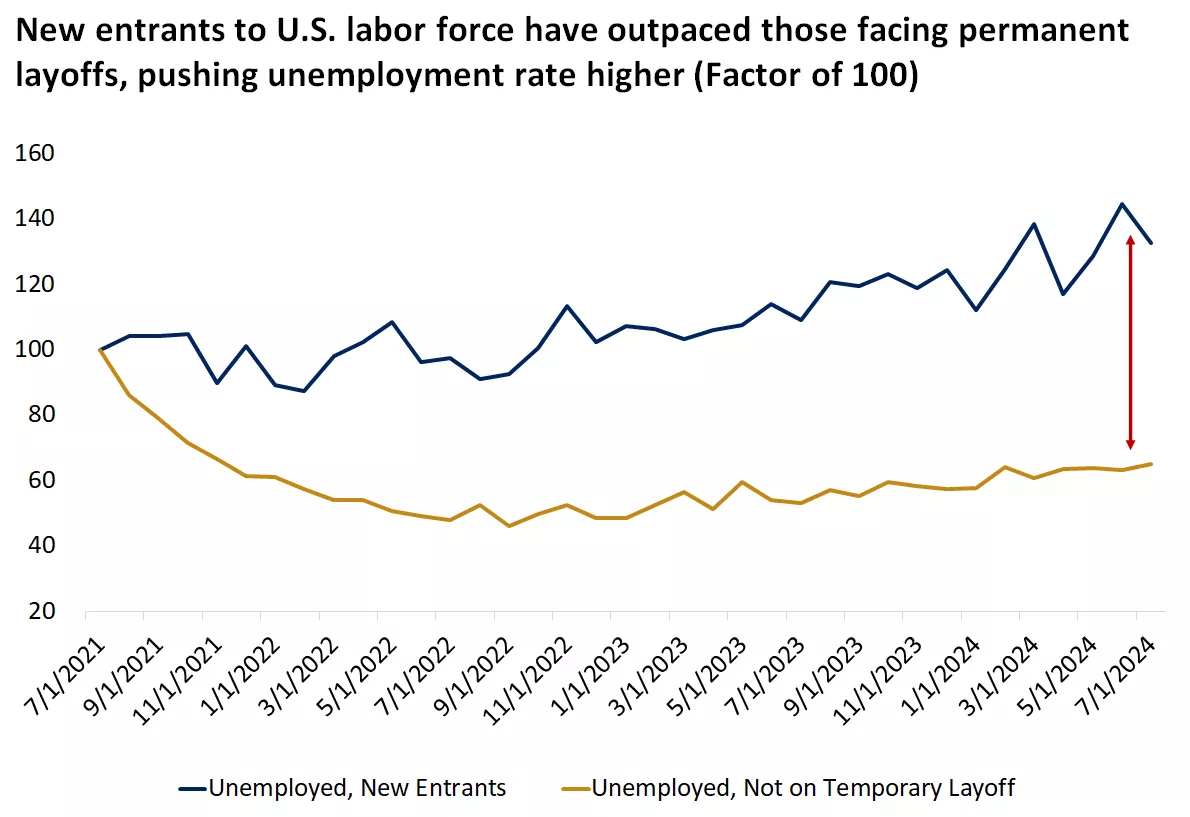

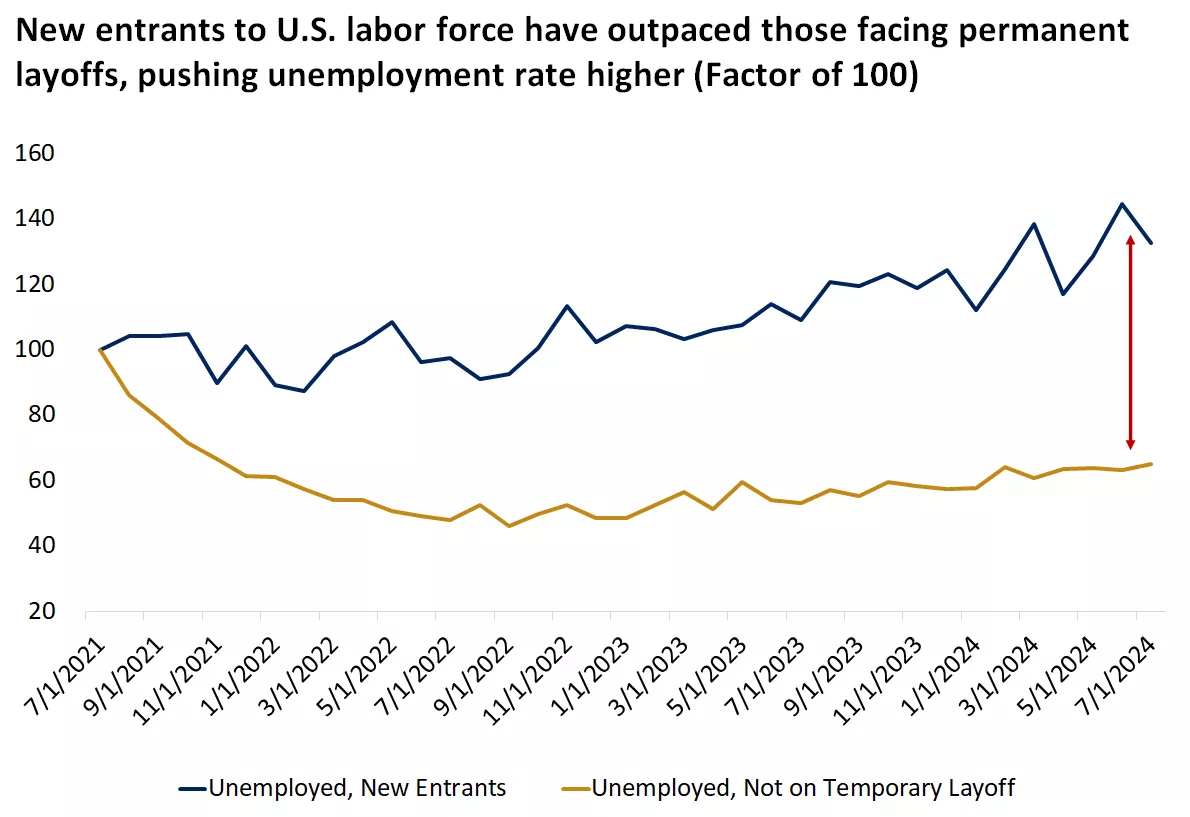

In our view, the unemployment rate is normalizing after a strong post-pandemic rebound, remaining well below historical averages of around 5%. Additionally, the rise in unemployment was primarily driven by an uptick in labor supply (more people joining the labor force) as opposed to a contraction in employment. We also saw a sharp rise in temporary layoffs, which were likely due to one-off factors like Hurricane Beryl and may reverse going forward. And as we'll highlight below, we don't see signs that the U.S. economy is falling into recession.

This chart shows that the rise in the unemployment rate has been primarily due to new entrants to the labor market as opposed to a contraction in employment.

This chart shows that the rise in the unemployment rate has been primarily due to new entrants to the labor market as opposed to a contraction in employment.

2. Japan “carry trade” unwinding — Another key factor in the recent volatility was the unprecedented moves in the Japanese equity market. On July 31, the Bank of Japan raised rates for the second time since 2007 and outlined a plan to scale back its massive bond-buying program. This comes as a stark contrast to much of the developed world, which is looking to cut interest rates and ease monetary policy.

These moves also rattled the “carry trade” investors who had borrowed in relatively cheaper Japanese yen to fund trades like U.S. technology stocks. As a result, the Japanese Nikkei index fell over 10% in one day, sparking a selloff in global equity markets.1

However, it should be noted that the Japanese market has since rebounded, recovering most of its losses, in part because the Bank of Japan pledged not to raise rates at a time when financial markets are volatile. This has supported stabilization in U.S. and global markets as well.

3. Overbought tech rally — And finally, a factor in last week’s selloff was likely some continuation of the selling pressure that had started in the mega-cap technology space. Tech and growth sectors have driven much of the rally for the first half of the year, with the Nasdaq up over 24% and the “Magnificent 7” stocks* up over 40% on average through mid-July.1 The tech sectors may have been ripe for a pause or pullback after rising perhaps too far, too fast.

In addition, on Aug. 3, we learned that Warren Buffett had sold half of his stake in Apple, the largest holding for Berkshire Hathaway, adding to the pressure on technology stocks. Given the combination of the weak economic data and the Japanese carry trade unwinding, the selling pressure in the mega-cap technology stocks intensified on Aug. 5. However, in our view, as economic growth cools, investors may once again gravitate toward steady earnings growers with solid balance sheets, and technology will likely be an integral part of this positioning.

Is the U.S. economy headed toward a recession? We don’t think so

Perhaps a key question for investors now is whether the U.S. economy is headed toward a recession. In our view, the U.S. economy is showing signs of slowing, but certainly not collapsing — for a few key reasons.

First, the labor market has cooled, but to us this appears to be a normalization after outsized strength in the post-pandemic period. In fact, while 114,000 nonfarm jobs were added in July (below expectations of 175,000), the three-month average gain in payrolls of roughly 170,000 is still in line with the average monthly gain in the 10 years leading up to the pandemic.1

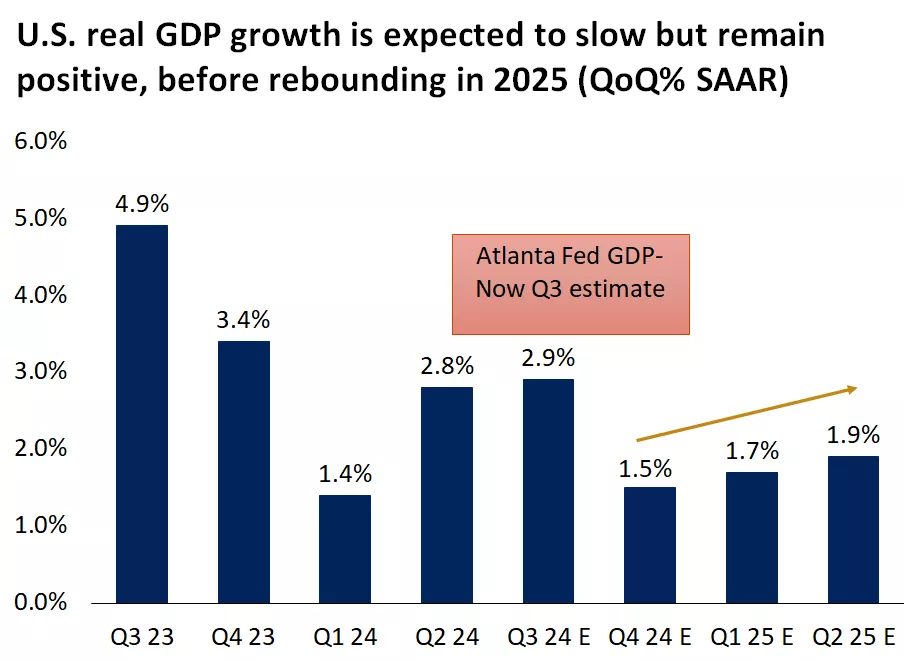

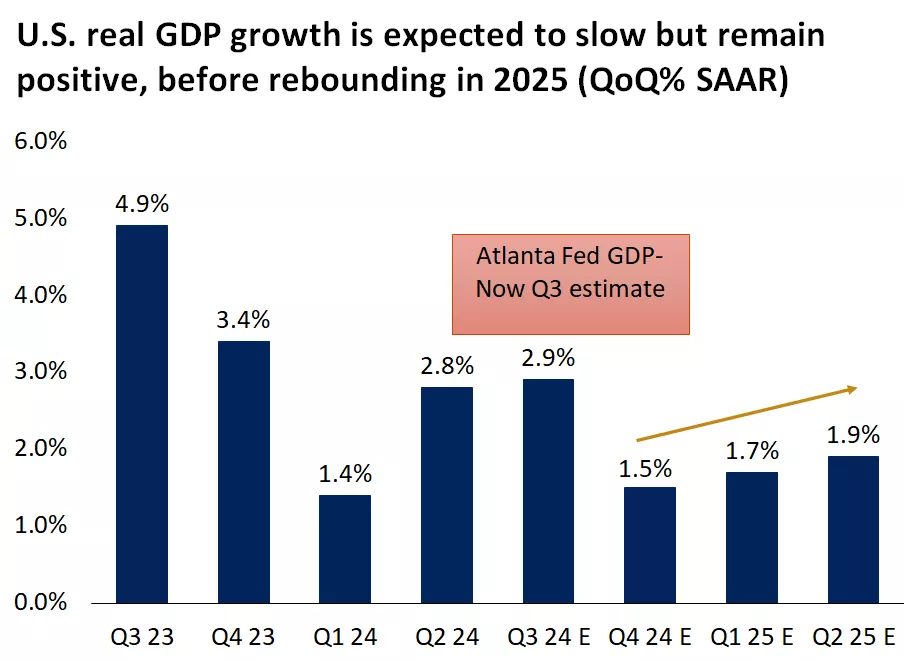

In addition, the first read of second-quarter U.S. GDP growth also was a healthy 2.8% annualized, driven by a solid 2.3% consumption rate. And for the third quarter, the Federal Reserve Bank of Atlanta’s GDPNow tracker is indicating a 2.9% growth rate. While these are below the average 3.2% quarterly growth rate in 2023, they remain above trend growth rates of 1.5% to 2%, and certainly don’t indicate an imminent recession.

This chart shows that U.S. real GDP growth is expected to remain positive in the quarters ahead.

This chart shows that U.S. real GDP growth is expected to remain positive in the quarters ahead.

Second, corporate earnings growth continues to deliver. We are more than 80% of the way through S&P 500 earnings for the second quarter. Earnings are on pace to grow by over 11%, up from expectations of 7.8% at the beginning of July and better than the 5.8% growth rate in the first quarter.1 Additionally, despite analysts trimming Q3 and Q4 estimates, S&P 500 earnings are expected to grow by over 10% for the full year, well above last year’s 1% growth rate and broadly supportive of equity markets.

As we head to the fourth quarter of 2024, the contribution to earnings growth is expected to come more so from outside technology sectors. This supports the case for a broadening of market leadership for both the growth and value/cyclical parts of the market.

Finally, the Fed remains poised to begin its rate-cutting cycle in September, in our view. Given the recent softening in the labor market and inflation’s moderation toward the Fed’s 2% target, both sides of the dual mandate seem to be calling for a less restrictive fed funds rate. We believe the Fed could start signaling rate cuts at its Jackson Hole symposium scheduled for Aug. 22-24.

As interest rates move lower, borrowing costs for consumers and corporations, including mortgage rates, will fall and should support consumption broadly. If inflation moderates and borrowing costs move lower, we could see a reacceleration in economic growth, which would also support a broadening of market leadership.

The selling was abrupt, but the bull market is intact: Stay invested

Overall, we don’t see the recent sharp pullback in equity markets as the start of a bear market phase. Given U.S. economic growth is slowing but positive, corporate profits are rising, and the Fed is ready to cut rates, we believe the foundations of the bull market remain supported.

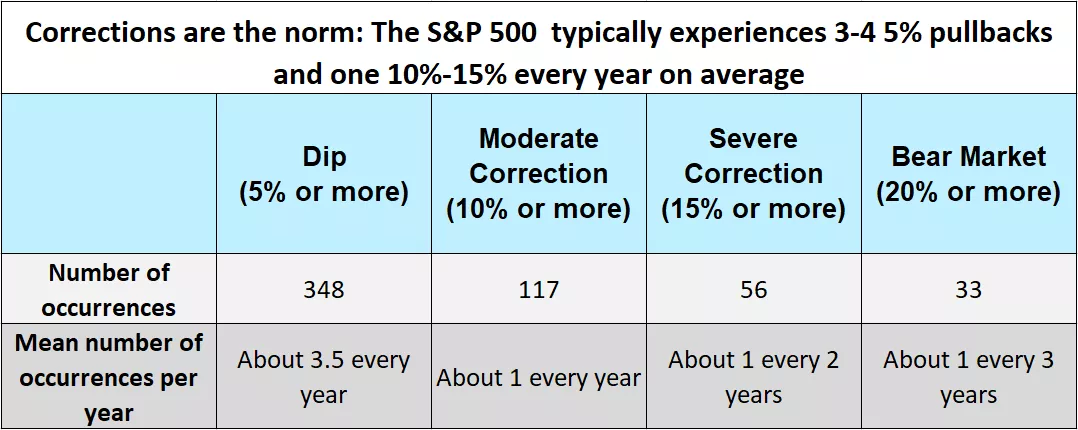

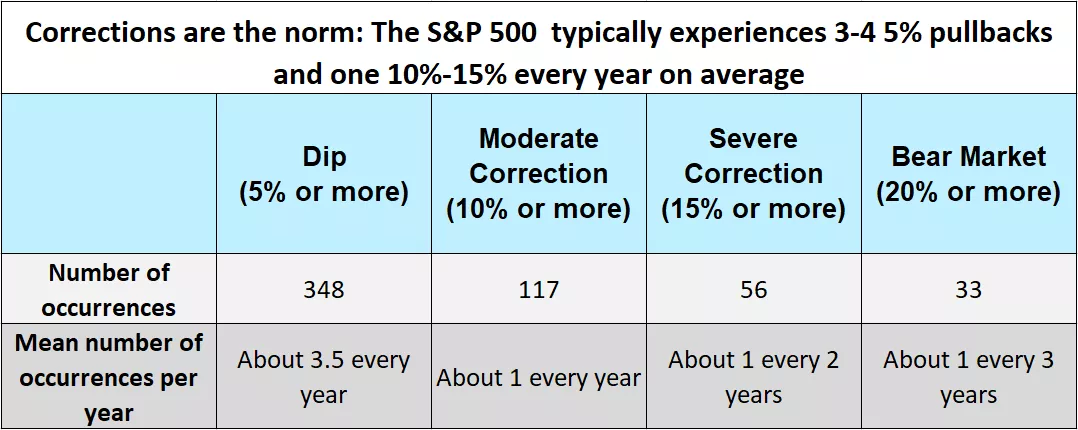

Keep in mind that market volatility is a normal part of investing. In fact, the S&P 500 experiences about three or four 5% pullbacks and one 10%-15% pullback every year on average.

Markets are already seeing some stabilization after the Aug. 5 selloff, with equity markets and Treasury yields rebounding from their lows. And while we expect a bottoming process to take time, with further market swings in the weeks ahead, we believe investors could use this volatility to revisit portfolio positioning.

We suggest working with your financial advisor to ensure your portfolio is adequately diversified, in both growth and non-growth parts of the market, and perhaps add quality investments according to your personal financial strategy. In addition, as rates move lower, investors should try to reduce any outsized positions in cash-like instruments, including CDs and money market funds.

We recommend using volatility to gradually reinvest in equities and bonds according to your strategic allocations. As a long-term investor, staying invested and adding to your portfolio in a disciplined approach remain bedrocks for achieving your financial goals, especially as the fundamental outlook for financial markets in our view remains sound.

This chart shows the number of 5%, 10%, 15%, and 20% pullbacks in the S&P 500 from 1928 – 2023. Past performance does not guarantee future results.

This chart shows the number of 5%, 10%, 15%, and 20% pullbacks in the S&P 500 from 1928 – 2023. Past performance does not guarantee future results.

Mona Mahajan

Investment Strategist

Source: 1. FactSet

Mona Mahajan

Senior Strategist, Investment Strategy

Mona Mahajan

Senior Strategist, Investment Strategy

Important information:

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.